Use these links to rapidly review the document

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material under §240.14a-12 | |

| Wolverine World Wide, Inc. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

Wolverine World Wide, Inc.

9341 Courtland Drive, N.E.

Rockford, Michigan 49351

March 28, 201727, 2018

Dear Fellow Shareholders,

Thank you for your investment in Wolverine Worldwide. We made significant progress on our strategic and financial objectives in 2017, including:

2016 was a year of great progress for our Company, with our Board of Directors and senior management team focused on addressing the dynamic and fast-changing consumer marketplace through a prioritization on innovation and growth, omnichannel transformation, and operational excellence. We opened a new design and innovation center, reorganized our European, Canadian, Apparel and Accessories, and Direct-to-Consumer businesses, and restructured our credit facility, while delivering nearly $300 million in operating cash flow, reducing year-endreduced inventories by 25%over 20%

These achievements helped reward the Company's shareholders, as the Company achieved over 45% total shareholder return for the year, resulting in performance at the 9188stth percentile of our peer group. Our strong performance hasWe expect continued intoprogress in 2018 as the Company seeks to execute its GLOBAL GROWTH AGENDA, and to shift its focus to long-term organic growth.

In addition to overseeing the Company's execution of our transformation and formulation of our blueprint for growth under the GLOBAL GROWTH AGENDA in 2017, the Board focused on other matters critical to the Company's long-term success, including Board and management succession planning, cybersecurity protection and brand stewardship, which we describe in greater detail in this proxy statement. We are proud of all we accomplished in 2017 and the Board will continue to lead the Company with 14.0% year-to-date total shareholder return through the March 13, 2017 record date fora view to continued success in 2018 and beyond. We hope to receive your support at this year's annual meeting.meeting on May 3, 2018, and encourage you to vote either online, by phone, or by mail.

Sincerely,

![]()

In addition, since our last annual meeting, the Compensation Committee engaged a new independent executive compensation consultant,Blake W. Krueger

Chairman, Chief Executive Officer and members of our Board of Directors and senior management team redoubled efforts to speak with shareholders to better understand your perspectives on important governance and compensation matters. Of primary importance this past year, following the disappointing results of our 2016 say-on-pay vote, was discussing our executive compensation program with shareholders and determining how to best demonstrate responsiveness to your concerns. We reached out to shareholders holding nearly two-thirds of our outstanding shares and held meetings, most of them in person, with more than half of these shareholders, including each shareholder who accepted our invitation. Joseph Gromek, the Chair of our Compensation Committee, led these meetings, which focused not only on our executive compensation program, but also on the Company's governance protocols and publicly-announced strategic initiatives. The details of this outreach effort and the changes made by the Compensation Committee in response to shareholder feedback are discussed throughout this Proxy Statement and within the Compensation Discussion and Analysis, but, in summary, we:President

| |

|

|

|

|

|

|

|

We greatly value the conversation we have had with our shareholders. We appreciate that this is an ongoing dialogue and look forward to continuing the conversation before, at, and after our 2017 Annual Meeting.

Sincerely,

![]()

David T. KollatLead Independent Director

| | | ||

| | | | |

| | | | |

NOTICE OF 20172018 ANNUAL MEETING OF SHAREHOLDERS

10:00 a.m., May 4, 20173, 2018

Wolverine World Wide, Inc.9341 Courtland Drive, N.E.500 Totten Pond RoadRockford, Michigan 49351Waltham, Massachusetts 02451

March 28, 201727, 2018

To ourOur Shareholders:

We invite you to attend Wolverine Worldwide's Annual Meeting of Shareholders at the Company's headquartersoffices located at 9341 Courtland Drive, N.E., Rockford, Michigan 49351,500 Totten Pond Road, Waltham, Massachusetts 02451, on Thursday, May 4, 2017,3, 2018, at 10:00 a.m. EDT. At the annual meeting, the shareholders will vote on the following items:

Shareholders of record as of March 13, 201712, 2018 can vote at the meeting and any adjournment of the meeting.

This Notice of 20172018 Annual Meeting of Shareholders, Proxy Statement, proxy or voting instruction card and Annual Report for our fiscal year ended December 31, 201630, 2017 are being mailed or made available to shareholders starting on or about March 28, 2017.27, 2018.

Whether or not you plan to attend, you can ensure that your shares are represented at the meeting by promptly voting and submitting your proxy by telephone or through the internet, or by completing, signing, dating and returning your proxy card in the enclosed envelope.

By Order of the Board of Directors

![]()

![]()

Brendan M. GibbonsDavid A. LatchanaSenior Vice President,Associate General Counsel and Assistant Secretary

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be held on May 4, 2017.3, 2018.

Wolverine's Proxy Statement for the 20172018 Annual Meeting of Shareholders and the Annual Report to Shareholders for the fiscal year ended December 31, 2016,30, 2017, are available atat:www.wolverineworldwide.com/2017annualmeeting2018annualmeeting.

| | |

|

|

|

|

|

|

Wolverine World Wide, Inc. ("Wolverine Worldwide" or the "Company") is furnishing this proxy statement and enclosed proxy card in connection with the solicitation of proxies by its Board of Directors to be used at the Annual Meeting of Shareholders of the Company occurring on May 4, 2017 at the Company's corporate headquarters in Rockford, Michigan (the "Annual Meeting"). Distribution of this proxy statement and enclosed proxy card to shareholders is scheduled to begin on or about March 28, 2017.

You can ensure that your shares are voted at the Annual Meeting by submitting your instructions by telephone or through the Internet, or by completing, signing, dating, and returning your proxy form in the enclosed envelope. Submitting your instructions or proxy by any of these methods will not affect your right to attend and vote at the Annual Meeting. The Company encourages shareholders to submit proxies in advance. A shareholder who gives a proxy may revoke it at any time before it is exercised by voting in person at the Annual Meeting, by delivering a subsequent proxy, or by notifying the inspectors of election in writing of such revocation. In order to vote any shares at the Annual Meeting that are held for you in a brokerage, bank, or other institutional account, you must obtain a proxy from that entity and bring it with you to hand in with your ballot.

References to "2016" or "fiscal 2016" in this proxy statement are to the Company's fiscal year ended December 31, 2016, unless otherwise noted in the text. References to "2017" or "fiscal 2017" in this proxy statement are to the Company's fiscal year ending December 30, 2017, unless otherwise noted in the text.

| | | ||

| | �� | | |

| | | | |

2017 PROXY STATEMENT

Table of Contents |

Letter to Shareholders | 1 | |

Notice of | ||

| ||

Proxy Statement Summary | ||

| ||

| 5 | |

Election of Directors for Terms Expiring in | ||

Board Highlights | ||

Board is Composed of Directors with the Right Mix of Skills and Experiences | ||

Shareholder Engagement | 7 | |

Corporate Governance Highlights | ||

| ||

| ||

| ||

| ||

| ||

| ||

Compensation Best Practices | ||

Corporate Governance | ||

Board of Directors | ||

Board Composition | ||

Director Nominations | ||

Board Self-Assessment | ||

Risk Oversight | ||

Code of Business Conduct and Accounting and Finance Code of Ethics | ||

Shareholder Communications Policy | ||

Proposal 1 – Election of Directors for Terms Expiring | 14 | |

Director Nominees with Proposed Terms Expiring in 2021 | 15 | |

Directors with Terms Expiring in 2019 | 18 | |

Directors with Terms Expiring in 2020 | ||

| ||

| ||

Board Leadership | ||

Director Independence | ||

Board Committees, Meetings and Meeting Attendance | ||

| ||

| ||

| ||

Non-Employee Director Compensation in Fiscal Year | ||

Non-Employee Director Stock Ownership Guidelines | ||

Securities Ownership of Officers and Directors and Certain Beneficial Owners | ||

Five Percent Shareholders | ||

Stock Ownership by Management and Others | 33 | |

Compensation Discussion and Analysis | 34 | |

Summary | 34 | |

Compensation Philosophy and Objectives | 34 | |

Compensation Decisions in Context: Key 2017 Accomplishments and Financial Highlights; 2018 Focus | 34 | |

CEO Annual Bonus/TSR Analysis | 35 | |

2017 Compensation Program Overview | 36 | |

Pay at Risk | 36 | |

Long-Term Incentive Program Mix | 37 | |

| 38 | |

Compensation Discussion and Analysis | 39 | |

| 39 | |

| 39 | |

| 39 | |

| ||

| 40 | |

Individual Performance Bonus | 42 | |

| ||

| 43 | |

| 44 | |

| 44 | |

2015-2017 Performance Shares | 44 | |

2017 Performance Share Awards | 45 | |

| ||

| 46 | |

Retirement, Deferred Compensation and Welfare Plans | 46 | |

Perquisites | 46 | |

Post-Employment Compensation | 46 | |

Compensation | ||

| ||

| 47 | |

Setting Targets | 47 | |

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

Competitive Philosophy and Competitive Market Data | ||

Peer Group | ||

New | ||

CEO Role | ||

Compensation Consultant Role | ||

Other Compensation Policies and Practices | ||

NEO Stock Ownership Guidelines | ||

Stock Hedging and Pledging Policies | ||

Clawback Policy | ||

Impact of Accounting and Tax Treatments on Compensation | ||

Compensation Committee Report | ||

Summary Compensation Table | ||

Grants of Plan-Based Awards in Fiscal Year | ||

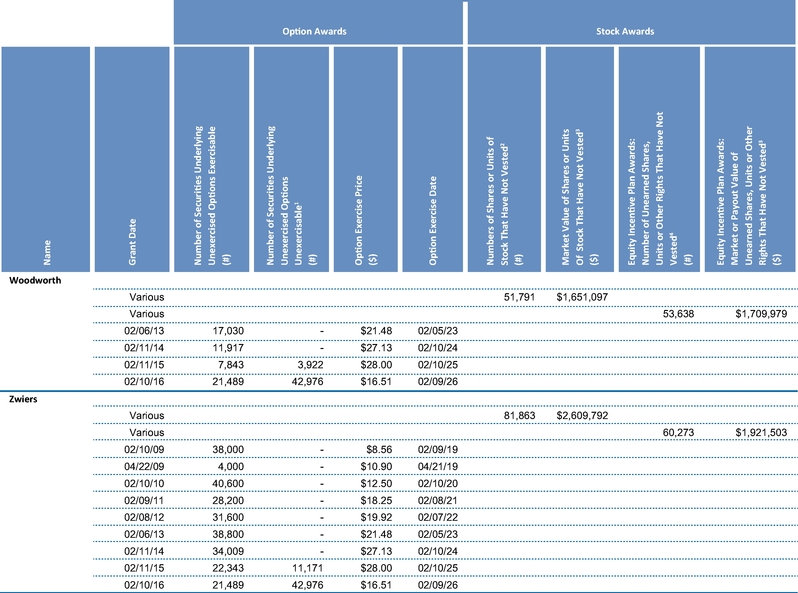

Outstanding Equity Awards at | ||

Option Exercises and Stock Vested in Fiscal Year | ||

Pension Plans and 2017 Pension Benefits | 60 | |

Qualified Pension Plans | 60 | |

Supplemental Executive Retirement Plan | 60 | |

Pension Benefits in Fiscal Year 2017 | 61 | |

Nonqualified Deferred Compensation | 62 | |

Nonqualified Deferred Compensation | 62 | |

Potential Payments Upon Termination or Change in Control | 63 | |

Benefits Triggered by Termination for Cause or Voluntary Termination | 63 | |

Benefits Triggered by Termination Other Than for Cause or for Good Reason | 63 | |

Benefits Triggered Upon a Change in Control | 63 | |

Benefits Triggered by Retirement, Death or Permanent Disability | 65 | |

|

| | | | |

| | | | |

| | | | |

2017 PROXY STATEMENT

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

Description of Restrictive Covenants that Apply During and After Termination of Employment | ||

Estimated Payments on Termination or Change in Control | ||

CEO Pay Ratio | 68 | |

Proposal 2 – Advisory Resolution | ||

Proposal 3 | ||

| ||

Audit Committee Report | ||

Independent Registered Public | ||

Proposal | ||

Overview | ||

| ||

| ||

Promotion of Good Corporate Governance Practices | 75 | |

Key Data | 75 | |

Section 162(m) of the Code | 76 | |

Plan Summary | 76 | |

Administration | 76 | |

Eligibility | 77 | |

Shares Subject to the Plan and to Awards | 77 | |

Stock Options | 78 | |

Stock Appreciation Rights | 78 | |

Restricted Stock and Restricted Stock Units | 78 | |

Stock Awards | 79 | |

Incentive Bonuses | 79 | |

Deferral of Gains | 79 | |

Qualifying Performance Criteria | 79 | |

Suspension or Termination of Awards | 80 | |

Settlement of Awards | 80 | |

No Repricing Without Shareholder Approval | 80 | |

Amendment and Termination | ||

Change in Control | 81 | |

Adjustments | 82 | |

Transferability | 82 | |

No Right to Company Employment | 82 | |

Effective Date and Termination of the Plan | 82 | |

Federal Income Tax Treatment | 82 | |

Stock Options | 83 | |

Stock Appreciation Rights | 83 | |

Restricted Stock and Restricted Stock Units | 83 | |

Stock Awards | 84 | |

Incentive Bonuses | 84 | |

Certain Change in Control Payments | 84 | |

Company Deduction and Section 162(m) of the Code | 84 | |

New Plan Benefits | 84 | |

Equity Compensation Plan Information | 85 | |

Vote Required and Board Recommendation | ||

Related Party Matters | ||

Certain Relationships and Related Transactions | ||

Related Person Transactions Policy | ||

Additional Information | ||

Shareholders List | ||

Director and Officer Indemnification | ||

Section | ||

Shareholder Proposals for Inclusion in Next Year's Proxy Statement | ||

Other Shareholder Proposals for Presentation at Next Year's Annual Meeting | ||

Voting Securities | ||

Conduct of Business | ||

Vote Required for Election and Approval | ||

Voting Results of the Annual Meeting | ||

Attending the Annual Meeting | ||

Manner for Voting Proxies | ||

Revocation of Proxies | ||

Solicitation of Proxies | ||

Delivery of Documents to Shareholders Sharing an Address | ||

Access to Proxy Statement and Annual Report | ||

| A-1 | |

Appendix B – Forward-Looking Statements and Non-GAAP Reconciliation | B-1 |

| | | | |

| | | | |

| | | | |

This summary highlights key information that can be found in greater detail elsewhere in this Proxy Statement. This summary does not contain all of the information that shareholders should consider, and shareholders should read the entire Proxy Statement before voting.

SUMMARY OF SHAREHOLDER VOTING MATTERSOur Brand Portfolio

Wolverine Worldwide has a portfolio of brands organized into four key operating groups in fiscal 2017 as illustrated below:

In 2017, the Company successfully executed against the WOLVERINE WAY FORWARD, an enterprise-wide initiative to transform the Company in light of the fast changing retail environment, making progress in all four areas of key focus, or "sprint lanes:" Innovation & Growth; Operational Excellence; Portfolio Management; and People and Teams. Key executions included:

With much of this heavy lifting behind, the Company is now focusing on organic growth with its new GLOBAL GROWTH AGENDA, which is comprised of three key elements:

| | | | | | | | | | | | | |

| | Powerful Product Creation Engine | | Digital-Direct Offense | | International Expansion | | ||||||

| | | | | | | | | | | | | |

• Relentless and frequent introduction of craveable product • Capitalization on new creative design capabilities, stronger consumer insights, and a faster supply chain | • Seamless consumer interaction through more effective digital engagement • Drive owned eCommerce growth beyond 20% • Improve online businesses of our retail customers and enhance brand positioning | • Invest in regional resources and systems to accelerate international growth • Key focus on growth in China and the Asia Pacific region | ||||||||||

| | | | | | | | | | | | | |

| | | | |

| | | | |

2018 PROXY STATEMENT | | | | 5 |

Shareholders are being asked to vote on the following matters at the 20172018 Annual Meeting of Shareholders:

| | | | | | | | | | | | | | | | | | ||||

| PROPOSAL | BOARD VOTE RECOMMENDATION | PAGE REFERENCE | PROPOSAL | BOARD VOTE RECOMMENDATION | PAGE REFERENCE | | ||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| 1. | Election of Directors for Terms Expiring in 2020 | FOR each Nominee | 18 | |||||||||||||||||

| | | | | | | | | | | | 1. | Election of Directors for Terms Expiring in 2021 | FOR each Nominee | 14 | | |||||

| 2. | Advisory Resolution Approving NEO Compensation | FOR | 78 | |||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| 3. | Frequency of Future Advisory Votes on Executive Officers Compensation to be Every Year | EVERY ONE YEAR | 79 | |||||||||||||||||

| | | | | | | | | | | | 2. | Advisory Resolution Approving NEO Compensation | FOR | 69 | | |||||

| 4. | Ratification of Ernst & Young LLP as Auditor for Fiscal Year 2017 | FOR | 80 | |||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| 5. | Approval of the Amended & Restated Executive Short-Term Incentive Plan (Annual Bonus Plan) | FOR | 87 | |||||||||||||||||

| | | | | | | | | | | | 3 | Ratification of Ernst & Young LLP as Auditor for Fiscal Year 2018 | FOR | 70 | | |||||

| | | | | | | | | | | | ||||||||||

| | 4. | Approval of the Stock Incentive Plan of 2016 (as amended and restated) | FOR | 86 | | |||||||||||||||

| | | | | | | | | | | | ||||||||||

PROPOSAL 1 – ELECTION OF DIRECTORS FOR TERMS EXPIRING IN 20202021

The Company's Board consists of 11 directors. The Company's By-Laws establish three classes of directors, with each class being as nearly equal in number as possible and serving three-year terms.

The Board has nominated fourthree directors for election at the Annual Meeting, as outlined in the table below. Each director has been nominated to serve for a three-year term expiring at the annual meeting of shareholders to be held in 2020.2021.The Board recommends that shareholders vote "FOR" each of the nominees named below.

| | | | | | | | | | | | | | | | | |

| Age | Director Since | Independent | Other Public Directorships | Committees | Proposed Term Expiration | |||||||||||

| | | | | | | | | | | | | | | | | |

| William K. Gerber Managing Director, Cabrillo Point Capital | 63 | 2008 | ✓ | AK Steel Holding Corporation | Audit (Chair) Compensation | 2020 | ||||||||||

| | | | | | | | | | | | | | | | | |

| Blake W. Krueger Chairman, CEO & President of Wolverine World Wide, Inc. | 63 | 2006 | None | None | 2020 | |||||||||||

| | | | | | | | | | | | | | | | | |

| Nicholas T. Long Retired CEO of MillerCoors LLC | 58 | 2011 | ✓ | None | Compensation Governance | 2020 | ||||||||||

| | | | | | | | | | | | | | | | | |

| Michael A. Volkema Chairman of Herman Miller, Inc. | 61 | 2005 | ✓ | Herman Miller, Inc. | Audit Governance (Chair) | 2020 | ||||||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | Age | Director Since | Independent | Other Public Directorships | Committees | Proposed Term Expiration | | ||||||||

| | | | | | | | | | | | | | | | | |

| | Roxane Divol Former Executive Vice President and General Manger, Website Security for Symantec Corporation | 45 | 2014 | ✓ | None | Audit Governance | 2021 | | ||||||||

| | | | | | | | | | | | | | | | | |

| | Joseph R. Gromek Retired President, Chief Executive Officer and Director of The Warnaco Group, Inc. | 71 | 2008 | ✓ | Guess?, Inc. The Children's Place Retail Stores, Inc. | Compensation (Chair) Governance | 2021 | | ||||||||

| | | | | | | | | | | | | | | | | |

| | Brenda J. Lauderback Retired President of Wholesale and Retail Group of Nine West Group, Inc. | 67 | 2003 | ✓ | Denny's Corporation (Board Chair) Sleep Number Corporation | Audit Governance | 2021 | | ||||||||

| | | | | | | | | | | | | | | | | |

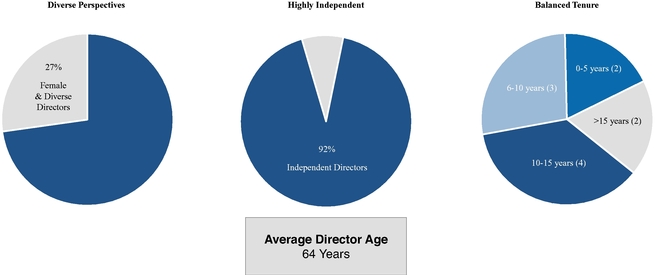

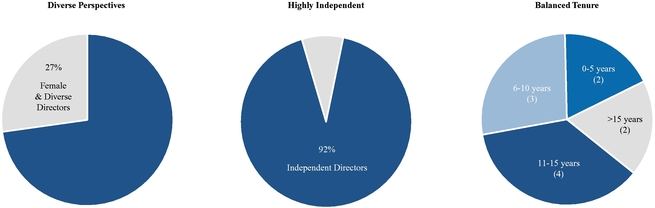

The following pie charts illustrate key characteristics of the Company's Board:

| | | | |

| | | | |

| | | | |

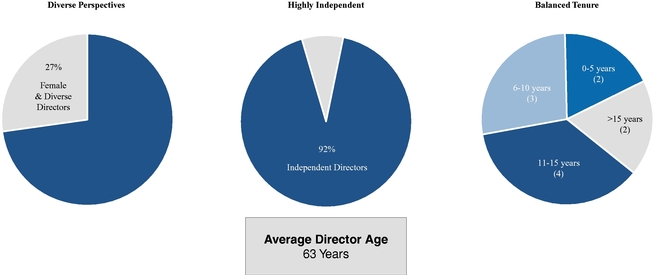

The following pie charts illustrate key characteristics of the Company's Board:

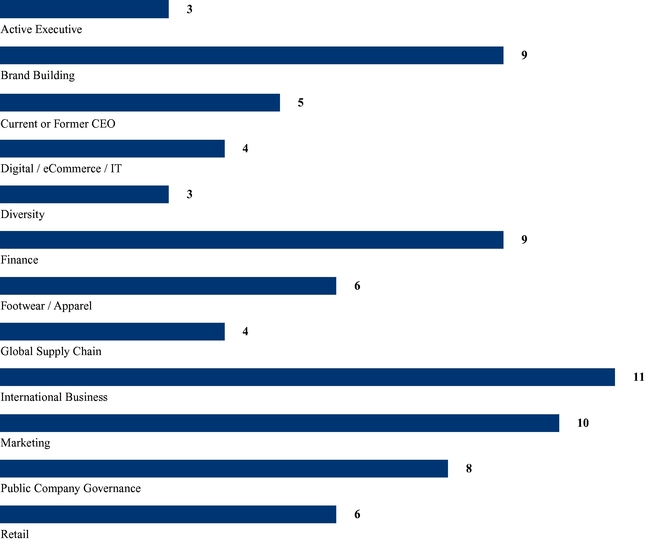

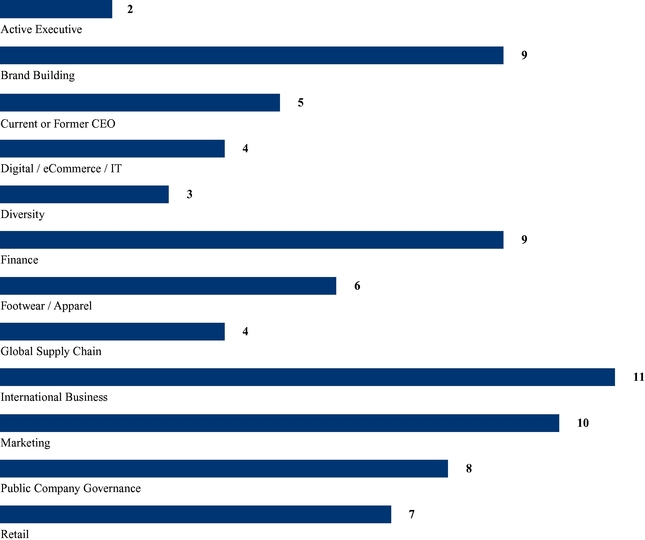

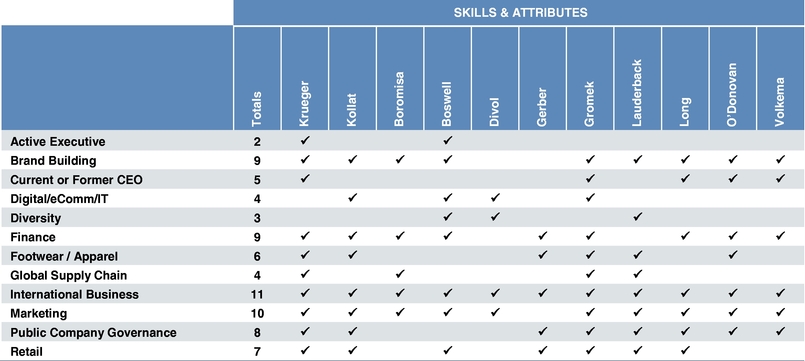

Board is Composed of Directors with the Right Mix of Skills and Experiences

The following chart lists the important experiences and attributes that the Company's Directors possess:

|

|

|

|

|

|

|

|

|

Our Board takes shareholder feedback very seriously, as evidenced by the meaningful changes made to our compensation and governance programs over the last several years. Most notable were the significant changes made to our executive compensation program in advance of our annual meeting last year. Shareholder response to these changes was overwhelmingly positive, which translated to 98% support for our say on pay proposal. As part of its ongoing shareholder engagement efforts, the Company reached out again in 2018 to shareholders representing 60% of its outstanding shares and has held or expects to hold telephonic meetings with all shareholders who accepted (representing about 13% of outstanding shares). Discussions focused on Company strategy, financial performance, governance and compensation programs.

Corporate Governance Highlights

Wolverine Worldwide is committed to a governance structure that provides strong shareholder rights and meaningful accountability:accountability.

✓ Highly independent Board (All Non-Management Directors) and Committees ✓ Lead Independent Director with clearly defined role ✓ Majority voting with director resignation policy ✓ No supermajority vote requirements ✓ Shareholder right to act by written consent | ✓ Annual Board and Committee self-evaluations ✓ Robust Board and executive succession planning, including annual written director nominee evaluations ✓ Long-standing commitment toward diversity ✓ Director onboarding orientation program ✓ Active shareholder engagement practices | |||||

| | | | |

| | | | |

| | | | |

PROPOSAL 2 – ADVISORY VOTE TO APPROVE NEO COMPENSATION

For a more detailed discussion of compensation matters, please reference the CD&A beginning on page 39. While the outcome of this proposal is non-binding, the Board and Compensation Committee will consider the outcome of the vote when making future compensation decisions.The Board recommends that shareholders vote "FOR" the advisory vote to approve named executive officer compensation.

Wolverine Worldwide has a portfolio of brands organized into four key operating groups as illustrated below:

In 2016, the Company launched the WOLVERINE WAY FORWARD, an enterprise-wide initiative to transform the Company in light of the fast-changing retail environment. The WOLVERINE WAY FORWARD includes the following key components:

|

|

|

| |||||||||||||

|

|

|

|

|

|

|

|

|

Key 2016 Accomplishments and Financial Highlights

Key 2016 financial highlights and accomplishments against the Company's strategic priorities are below.

|

|

The Company's Board and management team were disappointed with the results of the 2016 say-on-pay vote, which failed to receive majority shareholder support. In response, the Compensation Committee and full Board undertook a thorough review of the Company's compensation program in order to determine how best to respond to shareholders. Since the 2016 annual meeting, the Company's Compensation Committee Chair has reached out to shareholders representing nearly two-thirds of its outstanding shares and has held meetings with more than half of these shareholders, mostly in person. The Company met with every shareholder who accepted its invitation to engage, and the Company's Compensation Committee Chairman, Joseph Gromek, led each of the meetings. After aggregating all shareholder feedback and sharing it with the full Board, the Compensation Committee made significant changes to the executive compensation program. The feedback received and the changes made in response are discussed in greater detail in the CD&A Summary beginning on page 39. Some highlights are summarized below:

|

| |

|

| |

|

| |

|

| |

|

|

|

|

|

|

|

|

|

|

|

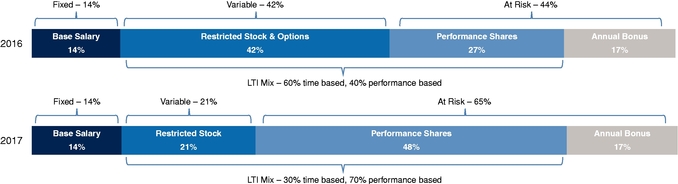

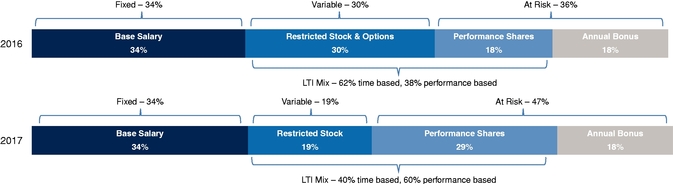

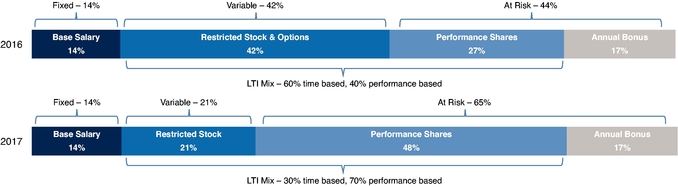

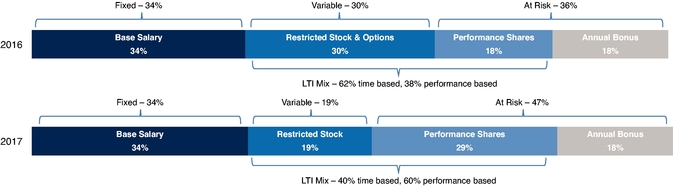

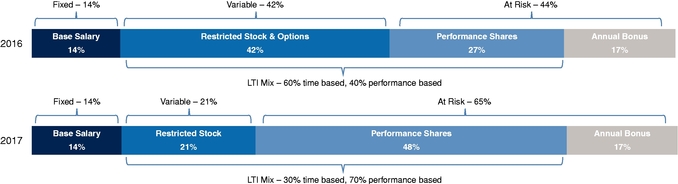

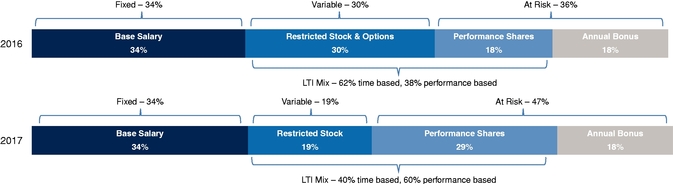

Compensation Philosophy – Pay at Risk

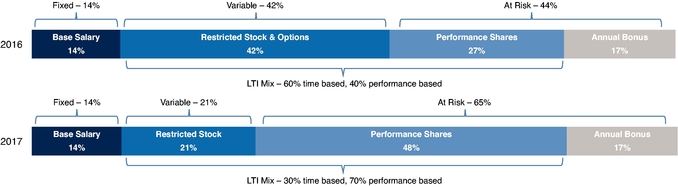

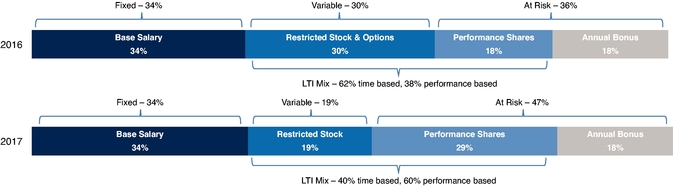

The Company's compensation philosophy is to align the interests of NEOs and shareholders by placing a significant portion of the compensation awarded to its NEOs generally, and the CEO in particular, at-risk (performance shares and annual bonus) and variable (restricted stock and, prior to 2017, stock options). The Compensation Committee believes this incentivizes superior business, stock price and financial performance and aligns the interests of executives with those of shareholders.

The below graphic illustrates the percentage of at-risk and variable target compensation for the CEO and the average of the other NEOs:

CEO 2016 vs. 2017 Target Total Compensation

Note: 2017 CEO equity grants were reduced by $500,000 compared to 2016 to respond to shareholders concerns regarding our 2016 say-on-pay vote. This one-time reduction is not reflected in the graphic above.

Other NEO 2016 vs. 2017 Target Total Compensation (Average)

|

|

|

|

|

|

|

|

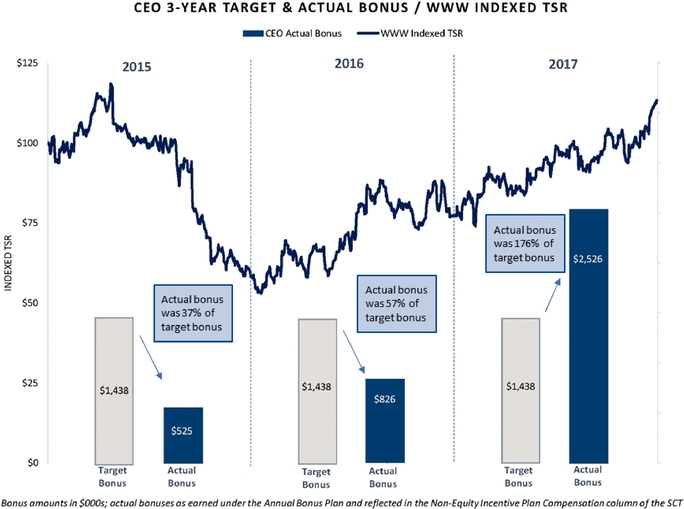

|

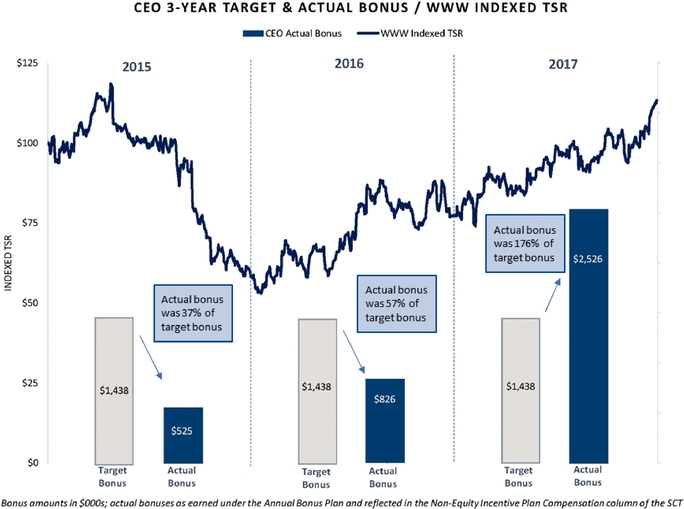

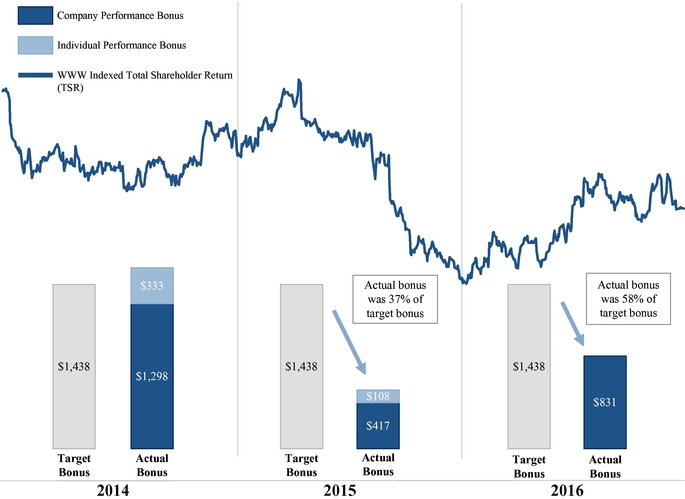

The below graphic illustrates the CEO's actual annual performance bonus compared to his target opportunity over the last three years and demonstrates the Company's pay-for-performance compensation philosophy in action – there is a clear link between Company TSR performance and annual bonus achievement over these periods. The CEO's target annual bonus opportunity has not increased over the past three years and was not increased in 2017.

CEO 3-Year Target & Actual Bonus(in $000s)

| What we do | What we do not do | |

✓ Vast majority of pay is ✓ Stringent share ownership requirements (6x base salary for CEO) ✓

✓ Significant vesting horizon for equity grants ✓

✓ Independent Compensation Committee Consultant | ✗ No dividends or dividend equivalents on unearned performance shares/units ✗ No repricing or replacing of underwater stock options ✗ No overlapping metrics ✗ No excessive or unnecessary perquisites ✗ No hedging, pledging, or short sales of Company stock |

The below graphics illustrate how the increased percentage of NEO target compensation that is at risk increased in 2017 as well as a comparison of CEO annual bonus compared to target opportunity and Company TSR, reflecting the Company's pay for performance philosophy.

CEO 2016 vs. 2017 Target Total Compensation

Other NEO 2016 vs. 2017 Target Total Compensation

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

2018 PROXY STATEMENT | | | | 9 |

2017 PROXY STATEMENT

Corporate Governance |

Wolverine Worldwide is committed to the highest level of corporate governance, and the Board has adopted its Corporate Governance Guidelines to strengthen management accountability and promote long-term shareholder interests. These governance practices include:

✓ Highly independent Board (All Non-Management Directors) and Committees ✓ Lead Independent Director with clearly defined role ✓ Majority voting with director resignation policy ✓ No supermajority vote requirements ✓ Shareholder right to act by written consent | ✓ Annual Board and Committee self-evaluations ✓ Robust Board and executive succession planning, including annual written director nominee evaluations ✓ Long-standing commitment toward diversity ✓ Director onboarding orientation program ✓ Active shareholder engagement practices |

The shareholders elect directors to serve on the Company's Board of Directors (the "Board of Directors" or "Board"). The Board oversees the management of the business by the Chief Executive Officer ("CEO") and senior management. In addition to its general oversight function, the Board's additional responsibilities include, but are not limited to, the following:

The following charts illustrate Key Board characteristics:

|

|

|

|

|

|

|

|

|

2017 PROXY STATEMENT

The Board prides itself on its ability to recruit and retain directors who have high personal and professional integrity and have demonstrated exceptional ability and judgment to effectively serve shareholders' long-term interests. These skills and attributes also link with the Company's most important strategic objectives, such as eCommerce and digital growth, brand building, operational excellence and supply chain management, and international growth. The Board also values diversity, as evidenced by the current makeup of the Board. The Board believes that its directors, including the nominees for election as directors at the Annual Meeting, have these characteristics and valuable skills that provide the Company with the variety and depth of knowledge, judgment and strategic vision necessary to provide effective oversight of the Company.

To help accomplish this, and to assist in succession planning, the Board, at the recommendation of the Governance Committee, has identified specified skills and attributes it desires its members to possess. The below graphic lists these skills and attributes and indicates which of the directors possess each. As shown, these skills and attributes are well represented within the Board.

| | | | | ||||||||||||||||||||||||

| | | | | | |||||||||||||||||||||||

| | ||||||||||||||||||||||||||||

2018 PROXY STATEMENT | | | | |||||||||||||||||||||||||

| ||||||||||||||||||||||||||||

| 10 | ||||||||||||||||||||||||||||

The Governance Committee reviews with the Board on an annual basis the appropriate skills and characteristics desired of Board members in the context of the current make-upmakeup of the Board. The Board, with the assistance of the Governance Committee, annually assesses the current composition of the Board across many dimensions. As set forth in the Company's Corporate Governance Guidelines, which are posted on its website, this assessment addresses the above-referredabove referred skills and attributes and the individual performance, experience, age and skills of each director.

The Board's Governance Committee serves as its nominating committee. The Governance Committee, in anticipation of upcoming director elections and other potential or expected Board vacancies, evaluates qualified individuals and recommends candidates to the Board. The Governance Committee may retain a search firm or other external parties to assist it in identifying candidates, and the Governance Committee has the sole authority to approve the search firm's fees and retention terms, and to terminate the firm if necessary.

The Governance Committee considers candidates suggested by directors, senior management or shareholders. Shareholders may recommend individuals as potential director candidates by communicating with the Governance Committee through one of the Board communication mechanisms described under the heading "Shareholder Communications Policy." Shareholders that wish to nominate a director candidate must comply with the procedures set forth in the Company's By-Laws, which are posted on its website. Ultimately, upon the recommendation of the Governance Committee, the Board selects the director nominees for election at each annual meeting. In selecting director nominees, the Board considers candidates' performance as a director (which is assessed through an anonymous written peer evaluation), personal and professional integrity, ability and judgment, and likelihood to be effective, in conjunction with the other nominees and directors, in serving the long-term interests of the shareholders. The Governance Committee also considers candidates' relative skills, attributes, background and characteristics; independence under applicable New York Stock Exchange ("NYSE") listing standards and the Company's Director Independence Standards; potential to contribute to the composition and culture of the Board; and ability and willingness to actively participate in the Board and committee meetings and to otherwise devote sufficient time to Board duties.

|

|

|

|

|

|

|

|

|

2017 PROXY STATEMENT

As part of an annual self-assessment, each director evaluates the performance of the Board, and any committee on which he or she serves, across a number of dimensions. Mr. Kollat, as the Lead Independent Director working with the Governance Committee, reviews the Board self-assessment with directors following the end of each fiscal year, and conducts individual director interviews at the end of each year. Committee Chairpersons review the committee self-assessments with their respective committee members and discuss them with the Board. In addition, the Governance Committee, working with the Lead Independent Director, develops and implements guidelines for evaluating all directors standing for nomination and re-election.

| | | | |

| | | | |

2018 PROXY STATEMENT | | | | 11 |

The Corporate Governance Guidelines (including the Director Independence Standards), the Charter for each Board standing committee (Audit, Compensation and Governance), the Company's Certificate of Incorporation, By-Laws, Code of Business Conduct, and its Accounting and Finance Code of Ethics all are available on the Wolverine Worldwide website at:http://www.wolverineworldwide.com/investor-relations/corporate-governance/

The Board and applicable committees annually review these and other key governance documents.

The Board oversees the Company's risk management and mitigation activities with a focus on the most significant risks facing the Company, including strategic, operational, financial, and legal compliance risks. This oversight is conducted through presentations by and discussions with the CEO, Chief Financial Officer ("CFO"), General Counsel or Associate General Counsel, Chief Information Officer, brand and department leaders and other members of management. The Vice President of Internal Audit and Risk Compliance coordinates management's day-to-day risk management and mitigation efforts, and reports directly to the Audit Committee.

The Vice President of Internal Audit and Risk Compliance reviews with the Audit Committee periodically,regularly, and with the full Board annually,periodically, management's relatedrisk assessment and mitigation strategies. In addition to the above processes, the Board has delegated risk management and mitigation oversight responsibilities to its standing committees, which meet regularly to review and discuss specific risk topics that align with their core responsibilities.

The Company reviewed its compensation policies and practices to assess whether they are reasonably likely to have a material adverse effect on the Company. As part of this review, the Company compiled information about the Company's incentive plans, including reviewing the Company's compensation philosophy, evaluating key incentive plan design features and reviewing historic payout levels and pay mix. With assistance from Company management and its independent compensation consultant, the Compensation Committee reviewed the executive compensation program, and managers from the Company's human resources and legal departments reviewed the non-executive compensation programs.

|

|

|

|

|

|

|

|

|

2017 PROXY STATEMENT

CODE OF BUSINESS CONDUCT AND ACCOUNTING AND FINANCE CODE OF ETHICS

The Board has adopted a Code of Business Conduct for the Company's directors, officers and employees. The Board also has adopted an Accounting and Finance Code of Ethics ("Accounting and Finance Code") that focuses on the financial reporting process and applies to the Company's CEO, CFO and Corporate Controller.

The Company discloses amendments to or waivers from its Code of Business Conduct affecting directors or executive officers and amendments to or waivers from its Accounting and Finance Code on its website at:www.wolverineworldwide.com/investor-relations/corporate-governance/

| | | | |

| | | | |

2018 PROXY STATEMENT | | | | 12 |

SHAREHOLDER COMMUNICATIONS POLICY

Shareholders and other interested parties may send correspondence to the Board, the non-employee directors as a group, a specific Board committee or an individual director (including the Lead Director) in the manner described below.

The General Counsel or Associate General Counsel will provide a summary and copies of all correspondence (other than solicitations for services, products or publications) as applicable at each regularly scheduled meeting.

Communications may be sent via email through various links on our website atat:www.wolverineworldwide.com/investor-relations/corporate-governance/

or by regular mail c/o Senior Vice President, General Counsel, and Secretary, Wolverine World Wide, Inc., 9341 Courtland Drive, N.E., Rockford, MichiganMI 49351.

The General Counsel or Associate General Counsel will alert individual directors if an item warrants a prompt response from the individual director prior to the next regularly scheduled meeting. Items warranting a prompt response, but not addressed to a specific director, will be routed to the applicable committee Chairperson.

| | | | |

| | | | |

| | | | |

2017 PROXY STATEMENT

Proposal 1 |

The Company's Board consists of 11 directors. The Company's By-Laws establish three classes of directors, with each class being as nearly equal in number as possible and serving three-year terms. At each annual meeting, the term of one class expires. The Board has nominated fourthree directors for election at the Annual Meeting: William K. Gerber, Blake W. Krueger, Nicholas T. Long,Roxane Divol, Joseph R. Gromek, and Michael A. Volkema.Brenda J. Lauderback. Each director has been nominated to serve for a three-year term expiring at the annual meeting of shareholders to be held in 20202021 or until hishis/her successor, if any, has been elected and is qualified.

Messrs. Gerber, LongMr. Gromek and VolkemaMses. Divol and Lauderback are independent directors, as determined by the Board under the applicable NYSE listing standards and the Company's Director Independence Standards. Each director nominee currently serves on the Board. The shareholders elected Messrs. Gerber, Krueger, LongMr. Gromek and VolkemaMses. Divol and Lauderback at the Company's 20142015 annual meeting by affirmative vote of at least 98% of shares voted.

The Company is not aware of any nominee who will be unable or unwilling to serve as a director. However, if a nominee is unable to serve or is otherwise unavailable for election, the incumbent directors may or may not select a substitute nominee. If the directors select a substitute nominee, the proxy holder will vote the shares represented by all valid proxies for the substitute nominee (unless other instructions are given).

The biographies of the fourthree nominees and the other directors of the Company are below, along with a discussion of the experience and skills of each director.

| | | | |

| | | | |

| | | | |

2017 PROXY STATEMENT

|

| | | | ||||

| ||||||

|

|

|

| |||

| ||||||

| ||||||

|

|

|

|

|

|

|

|

|

2017 PROXY STATEMENT

| ||||||

|

|

|

| |||

| ||||||

| ||||||

|

|

|

|

|

|

|

|

|

2017 PROXY STATEMENT

| ||||||

|

|

|

| |||

| ||||||

| ||||||

|

|

|

|

|

|

|

|

|

2017 PROXY STATEMENT

| ||||||

|

|

|

| |||

| ||||||

| ||||||

BOARD RECOMMENDATION

The Board recommends that you vote "FOR" the election of the above nominees for terms expiring in 2020.

|

|

|

|

|

|

|

|

|

2017 PROXY STATEMENT

|

| | | | | |||

ROXANE DIVOL | ||||||

| Select Business Experience: | Board Committees: | Other Public Directorships: | |||

Career Highlights: | ||||||

Experience and Skills: | ||||||

| | | | |

| | | | |

| | | | |

2017 PROXY STATEMENT

| | | | | | | |

JOSEPH R. GROMEK | ||||||

| Select Business Experience: | Board Committees: | Other Public Directorships: | |||

Career Highlights: | ||||||

Experience and Skills: | ||||||

| | | | |

| | | | |

| | | | |

2017 PROXY STATEMENT

| | | | | | | |

BRENDA J. LAUDERBACK | ||||||

| Select Business Experience: | Board Committees: | Other Public Directorships: | |||

Career Highlights: | ||||||

Experience and Skills: | ||||||

BOARD RECOMMENDATION

The Board recommends that you vote "FOR" the election of the above nominees for proposed terms expiring in 2021.

| | | | |

| | | | |

| | | | |

2017 PROXY STATEMENT

Directors with Terms |

| | | | | | | |

JEFFREY M. BOROMISA | ||||||

| Select Business Experience: | Board Committees: | Other Public Directorships: | |||

Career Highlights: | ||||||

Experience and Skills: | ||||||

| | | | |

| | | | |

| | | | |

2017 PROXY STATEMENT

| | | | | | | |

GINA R. BOSWELL | ||||||

| Select Business Experience: | Board Committees: | Other Public Directorships: | |||

Career Highlights: | ||||||

Experience and Skills: | ||||||

| | | | |

| | | | |

| | | | |

2017 PROXY STATEMENT

| | | | | | | |

DAVID T. KOLLAT | ||||||

| Select Business Experience: | Board | Other Public Directorships: | |||

Career Highlights: | ||||||

Experience and Skills: | ||||||

| | | | |

| | | | |

| | | | |

2017 PROXY STATEMENT

| | | | | | | |

TIMOTHY J. O'DONOVAN | ||||||

| Select Business Experience: | Board Committees: | Other Public Directorships: | |||

Career Highlights: | ||||||

Experience and Skills: | ||||||

| | | | |

| | | | |

| | | | 21 |

Directors with Terms |

| | | | | | | |

WILLIAM K. GERBER | ||||||

| | Board Committees: | Other Public Directorships: | |||

Career Highlights: | ||||||

Experience and Skills: | ||||||

| | | | |

| | | | |

2018 PROXY STATEMENT | | | | 22 |

| | | | | | | |

BLAKE W. KRUEGER | ||||||

| Select Business Experience: | Board Committees: | Other Public Directorships: | |||

Career Highlights: | ||||||

Experience and Skills: | ||||||

| | | | |

| | | | |

2018 PROXY STATEMENT | | | | 23 |

| | | | | | | |

NICHOLAS T. LONG | ||||||

| Select Business Experience: | Board Committees: | Other Public Directorships: | |||

Career Highlights: | ||||||

Experience and Skills: | ||||||

| | | | |

| | | | |

2018 PROXY STATEMENT | | | | 24 |

| | | | | | | |

MICHAEL A. VOLKEMA | ||||||

| Select Business Experience: | Board Committees: | Other Public Directorships: | |||

Career Highlights: | ||||||

Experience and Skills: | ||||||

| | | | |

| | | | |

2018 PROXY STATEMENT | | | | 25 |

2017 PROXY STATEMENT

The Company's CEO currently also serves as the Chairman of the Board. Since 1993, the Company has had a lead independent director who functions in many ways similar to an independent Chairman. This long-establishedlong established structure provides the Board with independent oversight of the CEO's leadership. On an annual basis, the independent directors consider the appropriate leadership structure, including whether to separate the roles of Chairman and CEO, based upon the Board and Company's then-currentthen current circumstances. The independent directors believe that itsthe Board's current structure is appropriate at this time, and set the following enumuratedenumerated responsibilities for the lead independent director:

The Board annually assesses the independence of all directors. To qualify as "independent," the Board must affirmatively determine that the director is independent under the Company's Director Independence Standards, which are modeled after the listing standards of the NYSE. Under NYSE listing standards, the Board has determined that 10 of the Company's 11 directors are independent. Only Mr. Krueger, the Company's CEO, is not independent. All of the Board's committees are comprised entirely of independent directors. The independent directors generally meet in executive session at each regularly scheduled meeting.

The Director Independence Standards define an "Independent Director" as a director who the Board determines otherwise has no material relationship with the Company (either directly or as a partner, stockholdershareholder or officer of an organization that has a relationship with the Company), and who:

|

|

|

|

|

|

|

|

|

2017 PROXY STATEMENT

| | | | |

| | | | |

2018 PROXY STATEMENT | | | | 26 |

BOARD COMMITTEES, MEETINGS AND MEETING ATTENDANCE

The Board has three standing committees: Audit, Compensation and Governance. Each committee meets periodically throughout the year, and reports its recommendations to the Board. The Company expects directors to attend every meeting of the Board and the committees on which they serve and to attend the annual meeting of shareholders. In 2016,2017, all directors then serving on the Board attended the 20162017 Annual Meeting of Shareholders, and all directors attended at least 75% of the meetings of the Board (6(5 meetings in 2016)2017) and the committees on which they served. All directors are typically invited to and attend all committee meetings.

Each committee annually evaluates its performance to determine its effectiveness. The Board has determined that all committee members are "independent" as defined by NYSE listing standards. Furthermore, each Audit Committee member satisfies the NYSE "financial literacy" requirement. In addition, the Board has determined that Mr. Boromisa and Mr. Gerber are "audit committee financial experts" under Securities and Exchange Commission ("SEC") rules. Each committee's charter, with a complete list of the duties and responsibilities is available on the Company's website athttp://www.wolverineworldwide.com/investor-relations/corporate-governance/.

| | | | |

| | | | |

| | | | |

2017 PROXY STATEMENT

| | | | |

| | | | |

| | | | |

2017 PROXY STATEMENT

Non-Employee Director Compensation |

The Company's non-employee director compensation philosophy is to pay compensation that is competitive with the compensation paid by companies of similar size, in similar industries and with whom Wolverine Worldwide competes for director candidates. The Governance Committee, with input from management and from the Compensation Committee's independent compensation consultant, reviewed director compensation and compared it to market data, including a comparison to director compensation for the Company's Peer Group, as defined on page 56,48, and to that of companies in the 2014-20152015-2016 National Association of Corporate Director Compensation Report. Based on this review non-employee director compensation for 2016fiscal year 2017 did not change from 2015fiscal year 2016 levels. The following table provides information concerning the compensation of the Company's non-employee directors for fiscal year 2016.2017. Mr. Krueger receives compensation for his services as the Company's CEO and President, but does not receive any additional compensation for his service as a director or chairman.

Fees Paid in Cash | | | Cash Amounts Voluntarily Deferred | | | Cash Amounts Deferred Through Annual Equity Retainers | | Fees Earned or Paid in Cash1 | | Option Awards2 | | Total | Fees Paid in Cash | | | Cash Amounts Voluntarily Deferred | | | Cash Amounts Deferred Through Annual Equity Retainers | | Fees Earned or Paid in Cash1 | | Option Awards2 | | Totals | |||||||||||||||||||||||||||

Boromisa | $97,000 | + | - | + | $70,000 | = | $167,000 | + | $50,002 | = | $217,002 | $97,000 | + | - | + | $70,000 | = | $167,000 | + | $50,001 | = | $217,001 | ||||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

Boswell | $82,000 | + | - | + | $70,000 | = | $152,000 | + | $50,002 | = | $202,002 | $90,000 | + | - | + | $70,000 | = | $160,000 | + | $50,001 | = | $210,001 | ||||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Divol | $21,250 | + | $63,750 | + | $70,000 | = | $155,000 | + | $50,002 | = | $205,002 | $23,250 | + | $69,750 | + | $70,000 | = | $163,000 | + | $50,001 | = | $213,001 | ||||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

Gerber | $117,000 | + | - | + | $70,000 | = | $187,000 | + | $50,002 | = | $237,002 | $117,000 | + | - | + | $70,000 | = | $187,000 | + | $50,001 | = | $237,001 | ||||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gromek | - | + | $109,000 | + | $70,000 | = | $179,000 | + | $50,002 | = | $229,002 | - | + | $109,000 | + | $70,000 | = | $179,000 | + | $50,001 | = | $229,001 | ||||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

Kollat | $130,000 | + | - | + | $92,000 | = | $222,000 | + | $63,002 | = | $285,002 | $130,000 | + | - | + | $92,000 | = | $222,000 | + | $63,003 | = | $285,003 | ||||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Lauderback | $78,375 | + | $26,125 | + | $70,000 | = | $174,500 | + | $50,002 | = | $224,502 | $72,750 | + | $24,250 | + | $70,000 | = | $167,000 | + | $50,001 | = | $217,001 | ||||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

Long | $94,000 | + | - | + | $70,000 | = | $164,000 | + | $50,002 | = | $214,002 | $94,000 | + | - | + | $70,000 | = | $164,000 | + | $50,001 | = | $214,001 | ||||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

O'Donovan | $70,000 | + | - | + | $70,000 | = | $140,000 | + | $50,002 | = | $190,002 | $70,000 | + | - | + | $70,000 | = | $140,000 | + | $50,001 | = | $190,001 | ||||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

Volkema | - | + | $104,500 | + | $70,000 | = | $174,500 | + | $50,002 | = | $224,502 | - | + | $112,000 | + | $70,000 | = | $182,000 | + | $50,001 | = | $232,001 | ||||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name | Option Awards Outstanding at December 31, 2016 (#) | Name | Option Awards Outstanding at December 31, 2016 (#) | Option Awards Outstanding at December 30, 2017 (#) | Name | Option Awards Outstanding at December 30, 2017 (#) | ||||||||||

Boromisa | 75,191 | Kollat | 85,129 | 78,174 | Kollat | 90,476 | ||||||||||

| | | | | | | | | | | | | | ||||

Boswell | 35,644 | Lauderback | 65,321 | 44,735 | Lauderback | 68,304 | ||||||||||

| | | | | | | | | | | | | | | | | |

Divol | 30,911 | Long | 51,551 | 40,002 | Long | 60,642 | ||||||||||

| | | | | | | | | | | | | | | | | |

Gerber | 62,773 | O'Donovan | 69,083 | 67,864 | O'Donovan | 78,174 | ||||||||||

| | | | | | | | | | | | | | ||||

Gromek | 81,701 | Volkema | 46,235 | 71,864 | Volkema | 55,326 | ||||||||||

| | | | | | | | | | | | | | | | | |

| | | | |

| | | | |

| | | | |

2017 PROXY STATEMENT

The following table shows the non-employee director compensation program for 2016:fiscal year 2017:

| | Compensation Plan for | |||||||||

| | | | | | | | | | | |

| Component | | Cash | Options1 | Stock Units2 | ||||||

Newly Appointed or Elected Director | $0 | Number of options | ||||||||

| | | | | | | | | | | |

| Annual Director Fee | $70,000 | Number of options | Number of stock units with a grant date value | |||||||

| | | | | | | | | | | |

| Audit Committee Annual Fee | $15,000 | |||||||||

| | | | | | | | | | | |

| Audit Committee Chairperson Annual Fee | $20,000 | |||||||||

| | | | | | | | | | | |

| Compensation Committee Annual Fee | $12,000 | |||||||||

| | | | | | | | | | | |

| Compensation Committee Chairperson Annual Fee | $15,000 | |||||||||

| | | | | | | | | | | |

| Governance Committee Annual Fee | $12,000 | |||||||||

| | | | | | | | | | | |

| Governance Committee Chairperson Annual Fee | $15,000 | |||||||||

| | | | | | | | | | | |

| Lead Director Annual Fee | In lieu of the standard Annual Director Fee, the Lead Director was paid a Cash Retainer of $130,000. | In lieu of the standard stock option grant, the Lead Director received a number of stock options | In lieu of the standard stock unit grant, the Lead Director received stock units with a grant date value | |||||||

| | | | | | | | | | | |

The Company also:

2018 Updates. After a review of Wolverine's director compensation program compared to both its peer group and broader industry market surveys (FW Cook 2016 Director Compensation Report and NACD 2016-2017 Compensation Update Report), the Company modified director compensation as follows for 2018. Prior to this update, the Company had not adjusted its director compensation since 2015:

| | | | |

| | | | |

2018 PROXY STATEMENT | | | | 30 |

Director Deferred Compensation Plan. The Company's Amended and Restated Outside Directors' Deferred Compensation Plan (the "Deferred"Director Deferred Compensation Plan") is a supplemental nonqualified deferred compensation plan for non-employee directors. A separate non-employee director deferred compensation plan applies to benefits accrued under that plan before January 1, 2005. The Director Deferred Compensation Plan

|

|

|

|

|

|

|

|

|

2017 PROXY STATEMENT

permits all non-employee directors to voluntarily defer, at their option, 25%, 50%, 75% or 100% of their director fees. The Company establishes a book account for each non-employee director and credits the director's account with the annual equity retainer amount as described above and with a number of stock units equal to the amounts voluntarily deferred, each divided by the closing market price of common stock on the payment/deferral date. The Company also credits director accounts with dividend equivalents on amounts previously deferred in the form of additional stock units. The amounts credited to director accounts are treated as if invested in Wolverine Worldwide common stock. The number of stock units held in director accounts is set forth under the "Stock Ownership By Management and Others" table below.

Upon a director's termination of service, or such later date as a director selects, the Company distributes the stock units in the director's book account in shares of Wolverine Worldwide common stock in either a single, lump-sumlump sum distribution or annual installment distributions over a period of up to 20 years (10 years under the plan for benefits accrued before January 1, 2005). The Company converts each stock unit to one share of Wolverine Worldwide common stock.

Upon a "change in control," the Company distributes to the director, in a single, lump-sumlump sum distribution, Wolverine Worldwide common stock in a number of shares equal to the stock units credited to a director's book account. The Deferred Compensation Plan defines "change in control" as any of the following:

NON-EMPLOYEE DIRECTOR STOCK OWNERSHIP GUIDELINES

Each non-employee director must attain (and maintain) a minimum stock ownership level (including owned shares, the in-the-moneyin the money value of stock options, and stock units under the Directors' Deferred Compensation Plan) equal to six times the non-employee director annual cash retainer prior to being able to gift or sell any Company stock. During 2016,2017, all non-employee directors were in compliance with these guidelines.

| | | | |

| | | | |

| | | | |

2017 PROXY STATEMENT

Securities Ownership of Officers and Directors and Certain Beneficial Owners |

The following table sets forth information about those holders known by Wolverine Worldwide to be the beneficial owners of more than five percent of Wolverine Worldwide's outstanding shares of common stock as of March 13, 2017:12, 2018:

Amount and Nature of Beneficial Ownership of Common Stock | Amount and Nature of Beneficial Ownership of Common Stock | Amount and Nature of Beneficial Ownership of Common Stock | ||||||||||||||||||||||

Name and Address of Beneficial Owner | Sole Voting Power | Sole Investment Power | Shared Voting Power | Shared Investment Power | Total Beneficial Ownership | Percent of Class4 | Sole Voting Power | Sole Investment Power | Shared Voting Power | Shared Investment Power | Total Beneficial Ownership | Percent of Class4 | ||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | |

BlackRock, Inc.1 | 11,417,003 | 11,646,668 | - | - | 11,646,668 | 12.0% | ||||||||||||||||||

ArrowMark Colorado | 4,787,969 | 4,787,969 | - | - | 4,787,969 | 5.0% | ||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | |

Janus Capital Management LLC2 | 7,094,347 | 7,094,347 | 26,059 | 26,059 | 7,120,406 | 7.3% | ||||||||||||||||||

BlackRock, Inc.2 | 11,830,084 | 12,032,149 | - | - | 12,032,149 | 12.6% | ||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | |

The Vanguard Group3 | 128,438 | 7,959,136 | 11,475 | 134,678 | 8,093,814 | 8.3% | 183,790 | 8,446,510 | 12,875 | 188,840 | 8,635,350 | 9.1% | ||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

| | | | |

| | | | |

2017 PROXY STATEMENT

STOCK OWNERSHIP BY MANAGEMENT AND OTHERS

The following table sets forth the number of shares of common stock beneficially owned as of March 13, 2017,12, 2018, by each of the Company's directors and named executive officers and all of the Company's directors and executive officers as a group:

| Amount and Nature of Beneficial Ownership of Common Stock1 | Amount and Nature of Beneficial Ownership of Common Stock1 | |||||||||||||||||||||||||

| Deferred Stock Units, Sole Voting and/or Investment Power2,3 | Shared Voting or Investment Power4 | Stock Options5 | Total Beneficial Ownership | Percent of Class6 | | Deferred Stock Units, Sole Voting and/or Investment Power2,3 | Shared Voting or Investment Power4 | Stock Options5 | Total Beneficial Ownership | Percent of Class6 | |||||||||||||||

Jeffrey M. Boromisa | 58,901 | 27,972 | 69,083 | 155,956 | * | Jeffrey M. Boromisa | 67,674 | 27,972 | 71,864 | 167,510 | * | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gina R. Boswell | 9,481 | - | 35,644 | 45,125 | * | Gina R. Boswell | 11,517 | - | 44,735 | 56,252 | * | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | ||

Roxane Divol | 13,350 | - | 30,911 | 44,261 | * | Roxane Divol | 17,406 | - | 40,002 | 57,408 | * | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

William K. Gerber | 38,061 | - | 58,773 | 96,834 | * | William K. Gerber | 40,257 | - | 61,994 | 102,251 | * | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Joseph R. Gromek | 104,443 | - | 81,701 | 186,144 | * | Joseph R. Gromek | 110,877 | - | 71,864 | 182,741 | * | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | ||

Michael Jeppesen | 161,448 | - | 105,112 | 266,560 | * | David T. Kollat | 304,018 | - | 84,166 | 388,184 | * | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

David T. Kollat | 300,776 | - | 79,021 | 379,797 | * | Blake W. Krueger | 1,202,522 | 39,739 | 1,186,700 | 2,428,961 | 2.52% | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Blake W. Krueger | 1,363,761 | 50,000 | 971,345 | 2,385,106 | 2.44% | Brenda J. Lauderback | 62,235 | - | 61,994 | 124,229 | * | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | ||

Brenda J. Lauderback | 58,996 | - | 59,213 | 118,209 | * | Nicholas T. Long | 18,776 | - | 60,642 | 79,418 | * | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Nicholas T. Long | 16,678 | - | 51,551 | 68,229 | * | Timothy J. O'Donovan | 584,565 | - | 61,994 | 646,559 | * | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Timothy J. O'Donovan | 617,431 | - | 69,083 | 686,514 | * | Todd W. Spaletto | 9,819 | - | - | 9,819 | * | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | ||

Michael D. Stornant | 153,917 | - | 140,364 | 294,281 | * | Michael D. Stornant | 156,326 | - | 161,764 | 318,090 | * | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Michael A. Volkema | 58,417 | - | 46,235 | 104,652 | * | Michael A. Volkema | 63,913 | - | 55,326 | 119,239 | * | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Richard J. Woodworth | 126,907 | - | 58,279 | 185,186 | * | Richard J. Woodworth | 120,186 | - | 83,689 | 203,875 | * | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | ||

James D. Zwiers | 163,732 | 161,003 | 259,041 | 583,776 | * | James D. Zwiers | 125,067 | 154,025 | 209,100 | 488,192 | * | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

All directors and executive officers as a group (15 people) | 3,246,299 | 238,975 | 2,115,356 | 5,600,630 | 5.65% | All directors and executive officers as a group (17 people) | 3,042,827 | 221,736 | 2,410,665 | 5,675,228 | 5.81% | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Restricted Units | Performance Units | | | Restricted Units | Performance Units | ||||||

| | Krueger | | 69,196 | | 159,926 | | Krueger | | 109,753 | | 288,381 | | ||

| | | | | | | | | | | | | | | |

| | Jeppesen | | 13,100 | | 19,649 | | Spaletto | | 26,892 | | 48,957 | | ||

| | | | | | | | | | | | | | | |

| | Stornant | | 15,570 | | 23,355 | | Stornant | | 24,764 | | 41,817 | | ||

| | | | | | | | | | | | | | | |

| | Woodworth | | 14,643 | | 21,965 | | Woodworth | | 22,230 | | 37,737 | | ||

| | | | | | | | | | | | | | | |

| | Zwiers | | 15,548 | | 23,321 | | Zwiers | | 23,604 | | 40,069 | | ||

| | | | | | | | | | | | | | | |

| | | | |

| | | | |

| | |

2017 PROXY STATEMENT

A LETTER FROM OUR COMPENSATION COMMITTEE

Dear Shareholders,

As members of the Wolverine Worldwide Compensation Committee, two of our most important responsibilities are to ensure that our executive compensation program pays for performance and aligns with the interests of our shareholders. The disappointing outcome of our 2016 say-on-pay vote was a signal by our shareholders that you took issue with some aspects of our executive compensation program, and we were determined to understand your perspectives on this program and committed to making constructive changes in response.

To accomplish this, the Committee launched a direct shareholder engagement initiative and retained a new independent executive compensation consultant to help us assess our current plans and programs. Since the Company's 2016 annual meeting, we have reached out to shareholders representing nearly two-thirds of our outstanding shares and had conversations with more than half of these shareholders – meeting with every shareholder who accepted our invitation. Our Committee Chairman Joseph Gromek led this effort and was present for all of the conversations we had with our investors. The purpose of these meetings was twofold – to gain a better understanding of the specific shareholder concerns with our executive compensation program and to also get feedback on a number of changes to the program that the Committee was considering.

After aggregating the shareholder feedback, sharing it with the full Board and deliberating as a Committee, we made significant changes to our executive compensation program and took targeted actions to reduce the CEO's 2016 and 2017 compensation. These changes reflect the thoughtful and constructive insights we received from our shareholders and are summarized below:

We have listened to shareholder concerns and have taken significant steps to address them and improve the Company's overall compensation program. We are committed to the ongoing evaluation and improvement of our executive compensation program to further enhance alignment with the interests of our shareholders. We welcome the opportunity to engage and encourage you to reach out with any questions or concerns related to our program. Correspondence can be addressed to the Compensation Committee care of the Corporate Secretary, as set forth on page 17 of this proxy statement.

Sincerely,

The Wolverine Worldwide Compensation CommitteeJoseph R. Gromek (Chairman), Jeffrey M. Boromisa, William K. Gerber, Nicholas T. Long

|

|

|

|

|

|

| | |

2017 PROXY STATEMENT

Compensation Discussion |

| The Company's Compensation Discussion and Analysis ("CD&A") provides an overview and analysis of the executive compensation program for the Company's named executive officers ("NEOs"). For | ||

Blake W. Krueger | Chairman, Chief Executive Officer and President | |

| President, Wolverine | |

Michael D. Stornant | Senior Vice President, Chief Financial Officer and Treasurer | |

Richard J. Woodworth | President, Wolverine Boston Group | |

James D. Zwiers | ||

Compensation Philosophy and ObjectivesCOMPENSATION PHILOSOPHY AND OBJECTIVES

The Company's compensation philosophy is to provide executives with a competitive compensation package that is heavily weighted towards at-riskperformance-based (performance shares and annual bonus) and variable (restricted stock or restricted stock units and, prior to 2017, stock options) compensation in order to encourage superior business stock price and financial performance over the short and longer term and, by linking compensation with stock price performance, to closely align the interests of the Company's NEOs with those of its shareholders.shareholders without encouraging excess risk-taking. The Compensation Committee (the "Committee") oversees the Company's executive compensation program.

The executive compensation program has four primary objectives:

Shareholder OutreachCompensation Decisions in Context: Key 2017 Accomplishments and Financial Highlights; 2018 Focus

The Company's say-on-pay proposal received insufficient supportCompany performed well in 2017, delivering strong financial results, executing against its WOLVERINE WAY FORWARD transformation, and establishing its go-forward GLOBAL GROWTH AGENDA. In 2017, the Company:

| | | | |

| | | | |

| | |

Below is a list of the key themes heard during Mr. Gromek's conversations with shareholders and the Committee's actions in response, with additional details provided below the chart:

|

| |||||||||||

|

| |||||||||||

|

| |||||||||||

| ||||||||||||

|

| |||||||||||

|

| |||||||||||

|

| |||||||||||

|

| |||||||||||

|

|

|

|

|

|

| | |

Near the end of 2016, Wolverine Worldwide announced a holistic, enterprise-wide business initiative designed to transform the Company to compete and win in the fast-changing global consumer retail environment — the WOLVERINE WAY FORWARD. It includes four critical components:

|

|

|

| |||||||||||||

|

|

|

|

|

|

|

|

|

Compensation Decisions in Context: Key 2016 Accomplishments and Financial Highlights

The Company performed well in 2016, despite broad-based slowing of consumer demand, destabilizing geopolitical events, the continued strengthening of the U.S. dollar, over-stored U.S. retail sector, and other macroeconomic factors that combined to create a volatile consumer retail environment around the world and a challenging year for companies in the retail, footwear, apparel and consumer soft goods industries, as well as companies with significant international footprints. Notwithstanding this, however, the Company finished 2016 with significant accomplishments against its strategic priorities outlined above.

Compensation OverviewCEO Annual Bonus/TSR Analysis

Despite a solid yearThe below graphic shows the CEO's target bonus opportunity compared to his actual annual bonus earned over the last three years, which demonstrates the Company's pay for performance philosophy in action: there is clear directional alignment between the faceCompany's TSR performance and the CEO's annual bonus achievement over these periods. The Company's three-year TSR for this period was at the 68th percentile of macroeconomic and industry headwinds, NEO compensationthe Company's 2018 peer group while average CEO annual bonus payout was below target. The CEO's target on a number of measures and the Compensation Committee took additional actions, including:

| | | | |

| | | | |

| | | | |

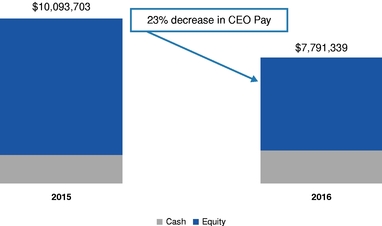

Year-Over-Year Change in CEO Pay

The graphic below presents the year-over-year change in the CEO's pay as disclosed in the Summary Compensation Table (SCT) on page 60, without impact of change in pension value. As shown, the year-over-year change in CEO's pay decreased from 2015 to 2016 by $2,342,955 or 23%.

Total CEO Pay*

|

|

|

|

|

|

|

|

|

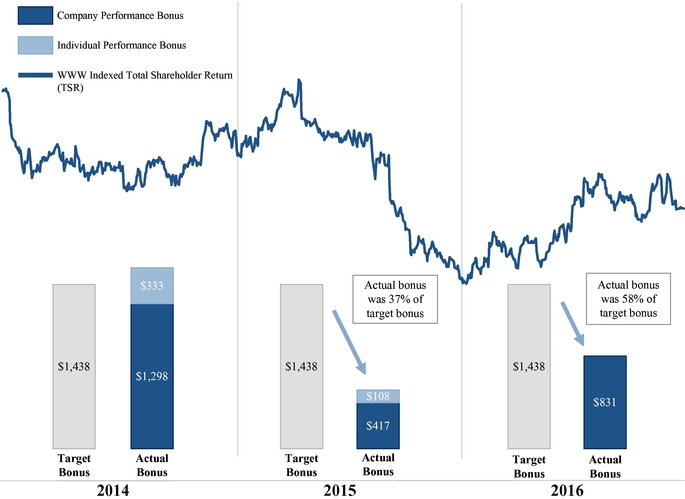

The below graphic shows the CEO's actual annual bonus compared to his target opportunity over the last three years and demonstrates a clear link between Company TSR performance and annual bonus achievement over these periods:

CEO 3-Year Target & Actual Bonus(in $000s)

|

|

|

|

|

|

|

|

|

2016 Compensation Program Overview

The Company's executive compensation program consists of base salary, annual bonus, long-term incentive compensation, and benefits. A breakdown of base salary, annual performance bonus, and long-term incentive compensation is illustrated below:

| ELEMENT | | COMPONENT | | METRICS | | WHAT THE PAY ELEMENT REWARDS | | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Base

|

• Cash

|

• Fixed amount based on responsibilities,

|

• Scope of core responsibilities, years of experience, and potential to affect the Company's overall performance

| |||||||||||

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Annual

|

• Company/Business Unit Cash Bonus • Individual Cash Bonus • Operating Margin Modifier

|

•

• 15% • Payout adjusted up/down up to plus or minus 25% based on operating margin modifier

|

• Achieving specific corporate business and/or divisional objectives over which the NEO has reasonable control • Achieving specific personal objectives • Achieving key financial metric, consistent with communicated objectives

| |||||||||||

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Long-Term

|

• Performance •

|

• Uses the following performance metrics (weighted as indicated) • 65% Adjusted earnings per share • 35% Adjusted business value-added • Relative TSR adjusted total payout up/down up to plus or minus 25% • Four-year vesting for time- vested restricted stock units

|

• Balances focus on near-term profitability with longer-term shareholder value creation • Achieving long-term corporate objectives • Driving long-term shareholder value • Continued, long-term employment at Wolverine Worldwide • Adjusted to increase (or reduce) payout based on relative TSR performance

| |||||||||||

| | | | | | | | | | | | | | | |

Under the Company's compensation program, a significant portion of the compensation awarded to the NEOs generally, and 2to the CEO in particular, is at risk (contingent upon the attainment of various pre-established short and long-term financial goals) and variable (contingent on the table on page 52.performance of the Company's stock price). NEO compensation that is significantly at risk and variable, incentivizes superior business and financial performance and, by linking compensation with stock price performance, aligns the interests of executives with those of shareholders.

| | | | |

| | | | |

2018 PROXY STATEMENT | | | | 36 |

The following graphic illustrates the increase to the percentage of 2017 NEO target compensation that is at risk:

CEO 2016 vs. 2017 Target Total Compensation

Other NEO 2016 vs. 2017 Target Total Compensation

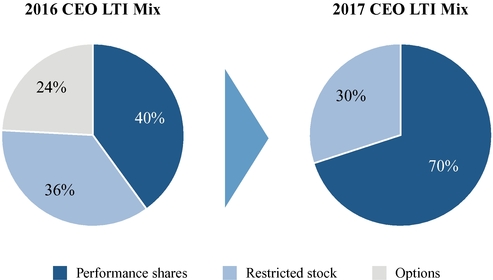

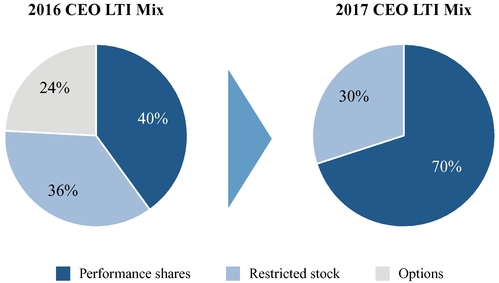

Long-Term Incentive Program Mix

Based on shareholder feedback during the Committee's outreach, theThe Committee decided to modifymodified the mix of vehicles used for long-term incentive compensation in 2017 and going forward. Beginning in 2017, the long-term incentive program does not utilize stock options and reflects a mix of 70% performance sharestock units and 30% time-vestedtime vested restricted sharestock units for the CEO. For other NEOs, the 2017 mix changed to 60% performance sharestock units and 40% time-vestedtime vested restricted sharestock units. This change is intended to strengthen the Company's pay-for-performancepay for performance philosophy while balancing retention objectives, create stronger alignment with shareholders and simplify the compensation program.

| | | | |

| | | | |

| | | | |

Under the Company's compensation program, a significant portion of the compensation awarded to the NEOs generally, and to the CEO in particular, is at-risk (contingent upon the attainment of various pre-established short and long-term financial goals) and variable (contingent on the performance of the Company's stock price). NEO compensation that is significantly at-risk and variable, incentivizes superior business, stock price and financial performance and aligns the interests of executives with those of shareholders.

The following graphic shows the percentage of at-risk and variable target compensation of the CEO and the average of the other NEOs:

CEO 2016 vs. 2017 Target Total Compensation

Note: 2017 CEO equity grants were reduced by $500,000 compared to 2016 to respond to shareholder concerns regarding our 2016 say-on-pay vote. This one-time reduction is not reflected in the graphic above.

Other NEO 2016 vs. 2017 Target Total Compensation

| What we do | What we do not do | |

✓ Vast majority of pay is ✓ Stringent share ownership requirements (6x base salary for CEO) ✓ Broad-based clawback policy ✓ Significant vesting horizon for equity grants ✓

✓ Independent Compensation Committee Consultant | ✗ No dividends or dividend equivalents on unearned performance ✗ No repricing or replacing of underwater stock options ✗ No overlapping metrics ✗ No excessive or unnecessary perquisites ✗ No hedging, pledging, or short sales of Company stock |

| | | | |

| | | | |

| | | | |

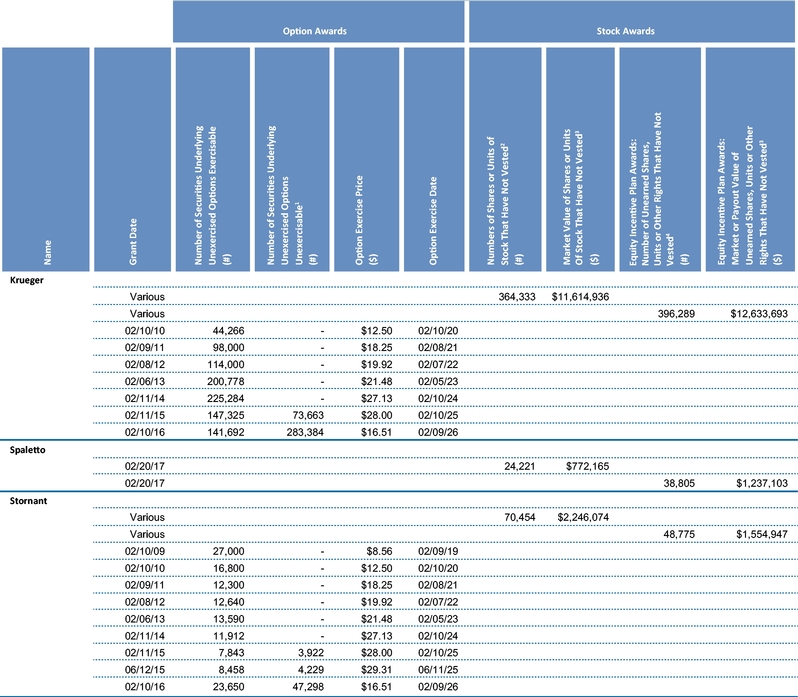

2017 PROXY STATEMENT